Successful companies build moats — ones that suppress the competition. Failing to create these moats can lead to serious losses for the company and investors. Some of these moats come naturally, and are generally there because the company has a unique advantage over its competitors.

For instance, in the early days of the iPhone, Apple had tremendous power over the market, and it took several years for other companies to catch up and create real competition. But usually, companies that experience that kind of competitive advantage don’t hold that position for too long. Soon enough some other company enters the industry and carves up a chunk of the market share.

A long-lasting competitive edge usually comes from a company’s ability to fund the cost of complicated compliance policies and comply with state and federal legislation. The cost of compliance can be very high in some industries, and naturally, that puts many companies at a disadvantage, leaving only the most established players to rake in the money.

Another example is the banking industry, which is dominated by a few large institutions with very few newcomers. The regulatory framework is so complex, and so expensive for the banks, that competition is eliminated by the process.

Basically, the lobbyist horde that crowds Capitol Hill is responsible for building extensive legislative moats to govern entire industries and individual companies they represent. This is true of every industry from tobacco to Big Pharma.

Did you know that global spending on pharmaceutical research is nearing $8 billion in 2019?

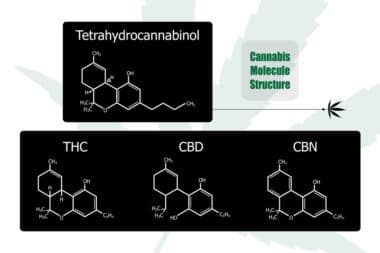

And as you can imagine, with so much money going into research and development, the biggest drug companies have yielded significant patentable intellectual property, and are able to form huge moats that protect their market share. In the age of legal marijuana and non-psychoactive hemp, Big Pharma is actively building patent moats in a broad field of commercial cannabis.

From the way the things look the marijuana industry is set to become a significant part of the health sector, with serious money going into research for new products. The best part is, product developers can grab sections of the market share away from the pharma companies and there’s little anybody can do to stop it from happening.

CBD is much more than an area of interest and anybody paying attention to consumer interest can see the potential to create products that sell in today’s market. To give you a clear example, let’s look at the new epilepsy medication that uses CBD.

CBD will threaten the shallow Epidiolex moat

Global sales of pharmaceutical products have risen close to $1 trillion, and some parts of this market (e.g. skin care, fitness, etc.) have already been filled with CBD products that work just as well as pharmaceuticals. The U.S. Food and Drug Administration approved a CBD drug called Epidiolex to treat one form of epilepsy, and this led to significant changes in attitudes toward cannabis in general, and of course, legal policy was also adjusted. For example, the Travel Safety Authority recently announced that they won’t be restricting hemp-derived CBD at the airports. This of course, will make CBD more prevalent throughout the U.S., as many of the products are small and easy to carry. (Also think of the anti-anxiety effect and its appeal to nervous flyers).

Epidiolex is made by the pharmaceutical company GW Pharmaceuticals. As soon as the FDA approval for their drug Epidiolex was announced, the FDA promptly rescheduled CBD to its lowest restriction classification (schedule 5). GW’s plan is to create a typical pharmaceutical moat around cannabidiol-based treatments for epilepsy, and presumably, they will follow this up by expanding into other treatments.

Epidiolex is just a formulation of CBD with a high concentration. Anybody can purchase CBD over-the-counter throughout the U.S., as long as it is extracted from hemp. CBD can be sourced from cannabis as well; and that’s what Epidiolex is made of (cannabis-extracted CBD). This is why GW needed the drug to be rescheduled, so the company can brand the product as treatment for a rare type of epilepsy.

Doctors probably already direct patients to use over-the-counter CBD to for this, and many other different treatments. And just as easily, patients can do a little online research at home and decide to try CBD. Either way, Big Pharma realizes that it’s far too easy for people to get CBD on their own. But that isn’t to say GW Pharmaceuticals won’t make money. They will make a lot of money from their new invention.

It’s necessary that investors realize something: big pharmaceutical companies relying on the old method of applying intellectual property tactics to secure a section of the market simply won’t work with CBD. They will face more challenges trying to convince people to use their CBD drug instead of just purchasing CBD products of their own choosing.

Investors who didn’t put money into those select CBD companies that are best placed to grow in this trillion dollar pharma industry will miss out on a great deal of business. What’s happening now is a once-in-a-lifetime opportunity to disrupt pharmaceutical business by providing a product that consumers have shown they want to purchase from vendors.

There are also an increasing number of reports that back up the idea that over-the-counter CBD sales will flourish. Unlike GW’s drug Epidiolex, over-the-counter CBD products require lower doses; which means patients experience fewer side effects. More importantly for consumers, CBD products that are sold over-the-counter tend to be cheaper than pharmaceutical drugs treating the same conditions. Patients can then treat severe forms of epilepsy using cheap and effective CBD sold all legally over the country.

Pharma has good reason to worry about CBD

Pharmaceutical companies are caught in a position where they have to play two sides of offense and defense. In the offense they are creating CBD drugs that work within the traditional pharmaceutical model of having to protect the high prices with comprehensive patent protections. That is the old moat. But in order to keep this model, they have to defend against the widespread availability of cheaper CBD treatments with an increasing body of evidence showing their effectiveness.

Patients will benefit from this and save thousands of dollars by getting their CBD in a food store instead of a doctor’s office. Both consumers and investors are starting to see this opportunity, and of course, Big Pharma is doing everything to leverage whatever position they have.

Reply